Understanding Your Bills and Notices

Below are the features of AES bills and notices. Choose the appropriate tab to learn more about the information included.

About Your Monthly Bill

- Twenty-one days prior to your payment due date, we send billing statements giving you plenty of time to make your payment.

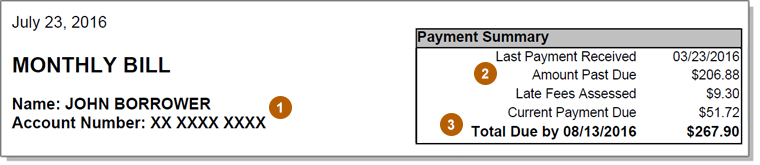

- You'll know you'll have a regular monthly bill if "MONTHLY BILL" appears in the upper left hand corner.

- If you are enrolled in our Paperless Billing, you will receive an email alerting you that you have mail in your Paperless Inbox.

Don't want paper?

Enroll in Paperless Billing today!

-

Account Number: The 10-digit number assigned to you.

Use this number when making any type of payment or when contacting our office via telephone communication or written correspondence.

-

Amount Past Due: Total amount unpaid since your last bill. If you are up to date on your payments, this will not display on your bill.

-

Total Due by: Make sure we receive your payment by this date so it can be posted to your account on time.

Also, note that if you make a payment on a weekend or holiday it may not show on your account until the following business day.

-

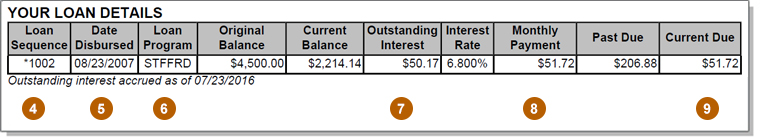

Loan Sequence: Number used to reference a specific loan.

-

Date Disbursed: The date the financial institution released the loan funds.

-

Loan Program: This is the loan type for each of your loans.

It is useful if you ever decide to apply for another payment plan because different plans have different loan program requirements.

-

Outstanding Interest: Shows the amount of interest that has not yet capitalized (been added to your principal balance).

-

Monthly Payment: Shows the breakdown of your monthly payment for each loan.

The total of this column makes up your monthly payment amount.

-

Current Due: Total amount due for the billing cycle.

Paying ahead, or paying more than your monthly installment, may help you pay off your loans faster.

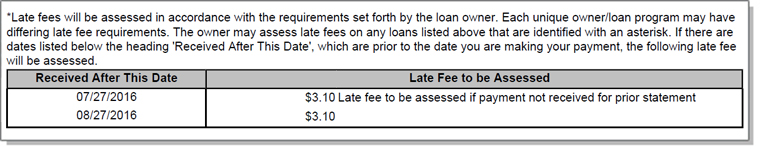

NOTE: Under 'Your Loan Details' there may be additional messaging depending on the owner of your loan(s). If the owner of your loan assesses late fees, you may see the above message. This portion will tell you the late fee that corresponds with each due date.

-

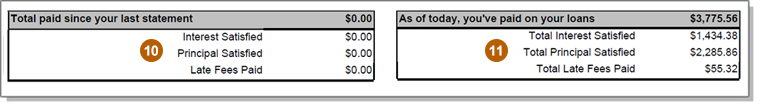

Total paid since your last statement: The total amount of your last payment which is the sum of the interest, principal, and fees.

-

As of today, you've paid on your loans: The total amount paid to date on your loans, including amount paid toward interest, principal, and fees.

Have questions about terms on your bill? Check out our glossary for help.

Still have questions? Contact Us.

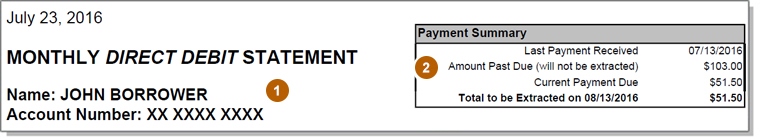

About Your Monthly Direct Debit Statement

- If you have loans enrolled in Direct Debit, you will receive a Monthly Direct Debit Statement 21 days prior to the withdrawal date.

- You'll know you'll receive a Monthly Direct Debit Statement if "MONTHLY Direct Debit STATEMENT" appears in the upper left hand corner.

- If you are enrolled in our Paperless Billing, you will receive an email alerting you that you have mail in your Paperless Inbox

Don't want paper?

Enroll in Paperless Billing today!

-

Account Number: The 10-digit number assigned to you.

Use this number when making any type of payment or when contacting our office via telephone communication or written correspondence.

-

Amount Past Due: Total amount unpaid since your last bill. If you are up to date on your payments, this will not display on your bill.

-

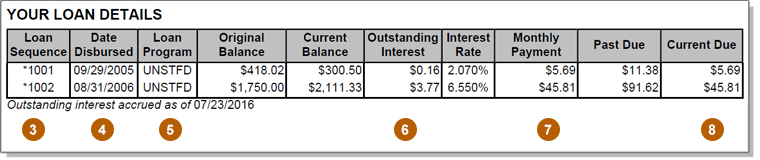

Loan Sequence: Number used to reference a specific loan.

-

Date Disbursed: The date the financial institution released the loan funds.

-

Loan Program: This is the loan type for each of your loans.

It is useful if you ever decide to apply for another payment plan because different plans have different loan program requirements.

-

Outstanding Interest: Shows the amount of interest that has not yet capitalized (been added to your principal balance).

-

Monthly Payment: Shows the breakdown of your monthly payment for each loan.

The total of this column makes up your monthly payment amount.

-

Current Due: Total amount due for the billing cycle.

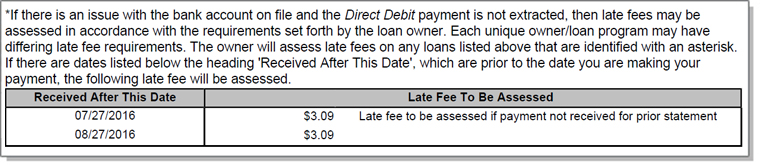

NOTE: Under 'Your Loan Details' there may be additional messaging depending on the owner of your loan(s). If the owner of your loan assesses late fees, you may see the above message. This portion will tell you the late fee that corresponds with each due date.

-

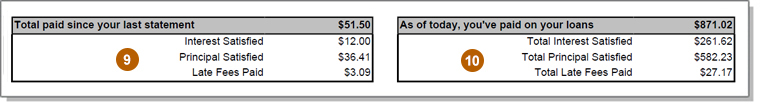

Total paid since your last statement: The total amount of your last payment, which is the sum of the interest, principal, and fees.

-

As of today, you've paid on your loans: The total amount paid to date on your loans, including amount paid toward interest, principal, and fees.

Have questions about terms on your bill? Check out our glossary for help.

Still have questions? Contact Us.

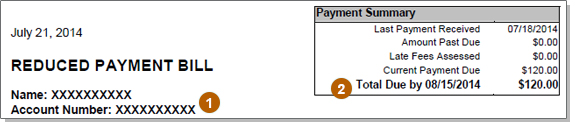

About Your Reduced Payment Bill

- Twenty-one days prior to your payment due date, we send billing statements giving you plenty of time to make your payment.

- You'll know you'll have a Reduced Payment Bill if "REDUCED PAYMENT BILL" appears in the upper left hand corner.

Don't want paper?

Enroll in Paperless Billing today!

-

Account Number: The 10-digit number assigned to you.

Use this number when making any type of payment or when contacting our office via telephone communication or written correspondence.

-

Total Due By: Make sure we receive your payment by this date so it can be posted to your account on time.

Also, note that if you make a payment on a weekend or holiday it may not show on your account until the following business day.

-

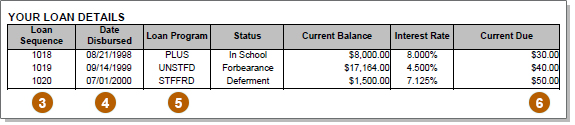

Loan Sequence: Number used to reference a specific loan.

-

Date Disbursed: The date the financial institution released the loan funds.

-

Loan Program: This is the loan type for each of your loans.

It is useful if you ever decide to apply for another payment plan because different plans have different loan program requirements.

-

Current Due: Total amount due for the billing cycle.

Paying ahead, or paying more than your monthly installment, may help you pay off your loans faster

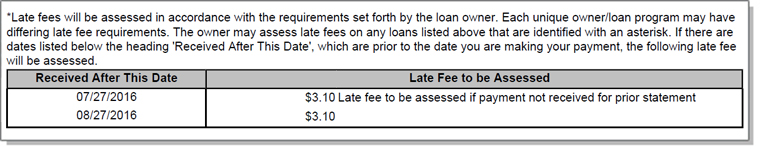

NOTE: Under 'Your Loan Details' there may be additional messaging depending on the owner of your loan(s). If the owner of your loan assesses late fees, you may see the above message. This portion will tell you the late fee that corresponds with each due date.

-

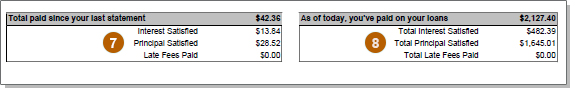

Total paid since your last statement: The total amount of your last payment, which is the sum of the interest, principal, and fees.

-

As of today, you've paid on your loans: The total amount paid to date on your loans, including amount paid toward interest, principal, and fees.

Have questions about terms on your bill? Check out our glossary for help.

Still have questions? Contact Us.

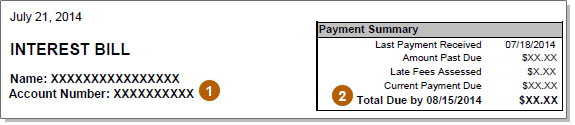

About Your Interest Bill

- Unlike a regular bill, you have the option to receive an Interest Bill while your loans are in deferment, forbearance, grace, or in-school status.

- Making Interest Bill payments prevents accrued interest from capitalizing (being added to your principal balance) before you start receiving regular monthly bills.

- We mail Interest Bills 21 days prior to your payment due date if you decide to pay your interest while in deferment, forbearance, grace, or in-school status.

Don't want paper?

Enroll in Paperless Billing today!

-

Account Number: The 10-digit number assigned to you.

Use this number when making any type of payment or when contacting our office via telephone communication or written correspondence.

-

Total Due By: Make sure we receive your payment by this date so it can be posted to your account on time.

Also, note that if you make a payment on a weekend or holiday it may not show on your account until the following business day.

-

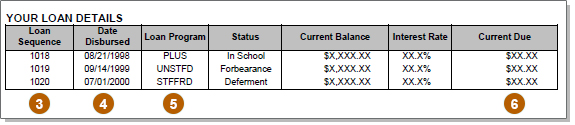

Loan Sequence: Number used to reference a specific loan.

-

Date Disbursed: The date the financial institution released the loan funds.

-

Loan Program: This is the loan type for each of your loans.

It is useful if you ever decide to apply for another payment plan because different plans have different loan program requirements.

-

Current Due: Total amount due for the billing cycle.

Paying ahead, or paying more than your monthly installment, may help you pay off your loans faster

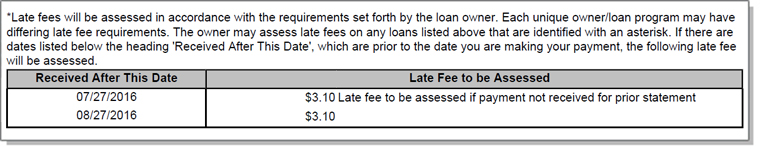

NOTE: Under 'Your Loan Details' there may be additional messaging depending on the owner of your loan(s). If the owner of your loan assesses late fees, you may see the above message. This portion will tell you the late fee that corresponds with each due date.

Have questions about terms on your bill? Check out our glossary for help.

Still have questions? Contact Us.

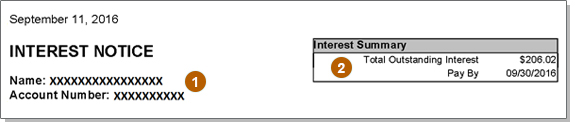

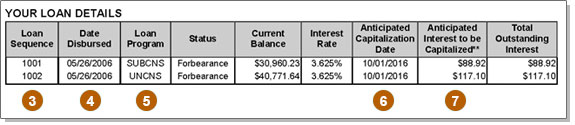

About Your Interest Notice

- Interest Notices differ from bills because you're not required to make a payment if your loan is in deferment, forbearance, grace, or in-school status.

- If you did not request to pay your interest in advance, we mail Interest Notices, at least once a year while you are in school, grace, deferment, or forbearance, giving you plenty of time to make your payment.

Don't want paper?

Enroll in Paperless Billing today!

-

Account Number: The 10-digit number assigned to you.

Use this number when making any type of payment or when contacting our office via telephone communication or written correspondence.

-

Interest Summary: This is the total amount of interest accrued on your loan up to the 'Pay By' date. If you would like to pay your interest before it is capitalized (added to your principal balance of your loan) you must pay it by the date shown.

-

Loan Sequence: Number used to reference a specific loan.

-

Date Disbursed: The date the financial institution released the loan funds.

-

Loan Program: This is the loan type for each of your loans.

It is useful if you ever decide to apply for another payment plan because different plans have different loan program requirements.

-

Anticipated Capitalization Date: The date the interest will be added to your Balance if you are unable to pay some or all of the Anticipated Capitalization Amount.

-

Anticipated Interest Amount to be Capitalized: The amount of interest that accumulated on your account- This amount is added to your principal balance if you are not able to pay it by the Pay By Date. Capitalization increases your student loan debt, which may result in a higher monthly installment amount, and it may take you longer to pay off your student loans. To avoid capitalization of interest pay the interest that accrues, if you are able to do so.

Have questions about terms on your bill? Check out our glossary for help.

Still have questions? Contact Us.